LTC Price Prediction: Bullish Technicals vs. Market Volatility

#LTC

- Technical Strength: LTC trades above key averages with bullish MACD.

- Institutional Support: $100M investment and Charlie Lee's board role boost credibility.

- Market Risks: Cloud mining trends and Bitcoin's performance may impact sentiment.

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

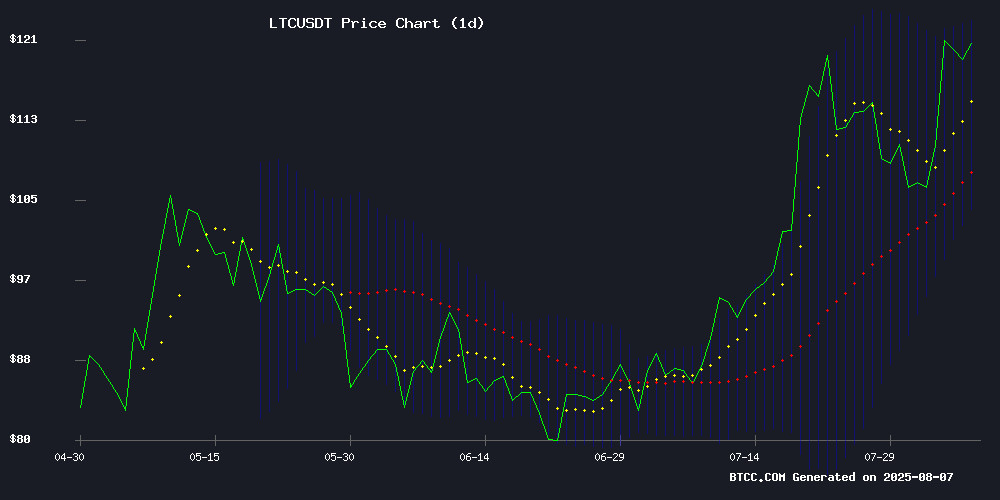

According to BTCC financial analyst Mia, Litecoin (LTC) is currently trading at $119.60, above its 20-day moving average (MA) of $113.45, indicating a bullish trend. The MACD histogram shows positive momentum at 3.1412, suggesting upward potential. Additionally, LTC is trading near the upper Bollinger Band at $122.97, which may signal overbought conditions but also reflects strong buying interest.

Mixed Sentiment for LTC Amid Market Shifts

BTCC financial analyst Mia notes that while Litecoin faces a 5% dip, institutional interest remains strong with MEI Pharma's $100M investment and the addition of Charlie Lee to its board. The broader crypto market shows stabilization, with Bitcoin holding at $115K. However, competition from cloud mining platforms like ALL4 Mining and Ineminer could divert attention from LTC in the short term.

Factors Influencing LTC’s Price

XRP and SOL Holders Shift to ALL4 Mining Amid Bitcoin Downturn

As Bitcoin's decline reverberates across the crypto market, holders of XRP and Solana are quietly migrating to ALL4 Mining, a platform promising consistent daily yields of up to $10,000 through computational contracts. The service bypasses traditional staking, offering short-term digital contracts that activate computing resources without requiring token liquidation.

ALL4 Mining distinguishes itself with zero management fees, McAfee-secured operations, and a multi-currency payment system spanning DOGE to USDC. Referral incentives amplify its appeal—users can earn $40,000 for successful sign-ups alongside a $15 instant registration bonus. This pivot reflects growing appetite for yield mechanisms decoupled from spot market volatility.

Ineminer Launches Free Cloud Mining Platform Amid Institutional Crypto Boom

Ineminer has unveiled a cloud mining service allowing users to mine Bitcoin and other cryptocurrencies without hardware requirements. The platform offers a $100 sign-up bonus, positioning itself as an accessible entry point for retail investors during a period of heightened institutional interest in digital assets.

The approval of Bitcoin ETFs and participation from firms like BlackRock and Fidelity have marked 2025 as a pivotal year for cryptocurrency adoption. While institutional players dominate ETF trading, Ineminer's mobile-first solution caters to individuals seeking alternative exposure through mining.

The service supports multiple cryptocurrencies including Bitcoin, Ethereum, Litecoin, and Dogecoin, leveraging AI to simplify the mining process. This development reflects the growing diversification of crypto investment vehicles beyond traditional exchange-traded products.

Crypto Market Stabilizes with Mixed Performances: Bitcoin Holds $115K, PUMP Surges 10%, Litecoin Dips 5%

Bitcoin's price hovers near the $115,000 resistance level, failing to sustain momentum above $115,322. Ethereum mirrors this consolidation, trading steadily around $3,600. Market uncertainty persists as technical indicators signal caution, keeping traders alert.

Pump.fun's memecoin defies the trend with a 10% surge, despite a 22.79% drop in trading volume to $449.68 million. The token's growing market share suggests accumulating investor interest.

Litecoin retreats 5% after recent gains, with its market cap now at $8.85 billion. Trading volume plummeted 47.33% to $1.01 billion, reflecting weakened momentum.

Polygon (POL) Leads CoinDesk 20 Higher with 4.1% Gain

The CoinDesk 20 Index edged up 0.2% to 3754.73, with Polygon's POL token spearheading the advance. Fourteen of the index's twenty constituents posted gains in the session.

POL surged 4.1% while Bitcoin Cash followed with a 2.2% rise. The rally contrasted with laggards Litecoin and Stellar, which fell 3.3% and 1.4% respectively.

Traded across multiple global platforms, the CoinDesk 20 serves as a benchmark for the digital asset market's performance. Today's movement reflects renewed appetite for layer-2 solutions amid broader crypto market stability.

MEI Pharma Invests $100M in Litecoin, Adds Charlie Lee to Board

MEI Pharma has made a bold entry into the cryptocurrency space by acquiring $100 million worth of Litecoin (LTC), marking the first instance of a U.S.-listed company adopting Litecoin as its primary reserve asset. The pharmaceutical firm purchased 929,548 LTC between July 30 and August 4 at an average price of $107.58, with the holdings now valued at approximately $115 million amid Litecoin's rise to $124.

The investment was facilitated by a $100 million private placement led by Litecoin creator Charlie Lee and trading firm GSR. Lee has joined MEI's board, replacing Taheer Datoo, while GSR will oversee the company's crypto treasury. Other participants in the funding round included the Litecoin Foundation, ParaFi, Hivemind, Primitive, RLH Capital, and Delta Blockchain.

MEI cited Litecoin's 13-year operational history, low transaction fees, and rapid settlement times as key factors in its decision. The token's integration with platforms like BitPay, PayPal, and Robinhood further underscored its utility. While the company hinted at potential ventures into Litecoin mining, it confirmed that its core drug development programs, including the experimental cancer treatment voruciclib, remain unchanged.

Titan Partners Group acted as the sole placement agent, with legal counsel provided by Morgan, Lewis & Bockius LLP for MEI and Lucosky Brookman LLP for the placement.

Solana Stabilizes After Volatility as Cloud Mining Gains Traction Among Holders

Solana (SOL) has found stability in the $162-$165 range following a 10% retreat from its August high near $180. On-chain metrics reveal sustained confidence among investors, with TVL growth and whale accumulation reinforcing the $155-$165 zone as a robust support level.

Technical analysts note a potential rebound toward $175-$180 if SOL conquers the $171-$172 resistance barrier. Amid this consolidation, BJMINING's cloud mining platform emerges as a hedge for holders, offering income generation without liquidating positions.

The service touts six competitive advantages: $15 registration bonuses, zero equipment costs, transparent fee structures, multi-currency withdrawals including SOL and BTC, and generous referral incentives. Such offerings increasingly position cloud mining as a strategic complement to spot holdings during periods of market uncertainty.

Cryptosolo Smart Cloud Mining Democratizes Crypto Wealth in 2025 Bull Market

The cryptocurrency market is riding a historic bull run in 2025, with Bitcoin hitting record highs and Ethereum upgrades drawing institutional capital. Amid this frenzy, cloud mining platform Cryptosolo is breaking down barriers to entry by turning smartphones into mining devices.

Gone are the days of expensive rigs and technical expertise—Cryptosolo's AI-driven system automatically switches between BTC, ETH, DOGE and LTC mining for optimal returns. The platform boasts military-grade security and regulatory compliance, having onboarded over 5 million users globally.

Three technological advantages underpin its growth: real-time coin switching algorithms, zero technical requirements, and enterprise-grade security protocols. This trifecta positions Cryptosolo at the vanguard of the cloud mining revolution, making crypto wealth accessible during what may become the sector's most prosperous year.

Is LTC a good investment?

LTC presents a mixed but leaning bullish case. Below is a summary of key metrics:

| Metric | Value | Implication |

|---|---|---|

| Price | $119.60 | Above 20-day MA ($113.45) |

| MACD | 3.1412 | Positive momentum |

| Bollinger Bands | Upper: $122.97 | Potential overbought |

Institutional backing (e.g., MEI Pharma) supports long-term growth, but short-term volatility may persist.